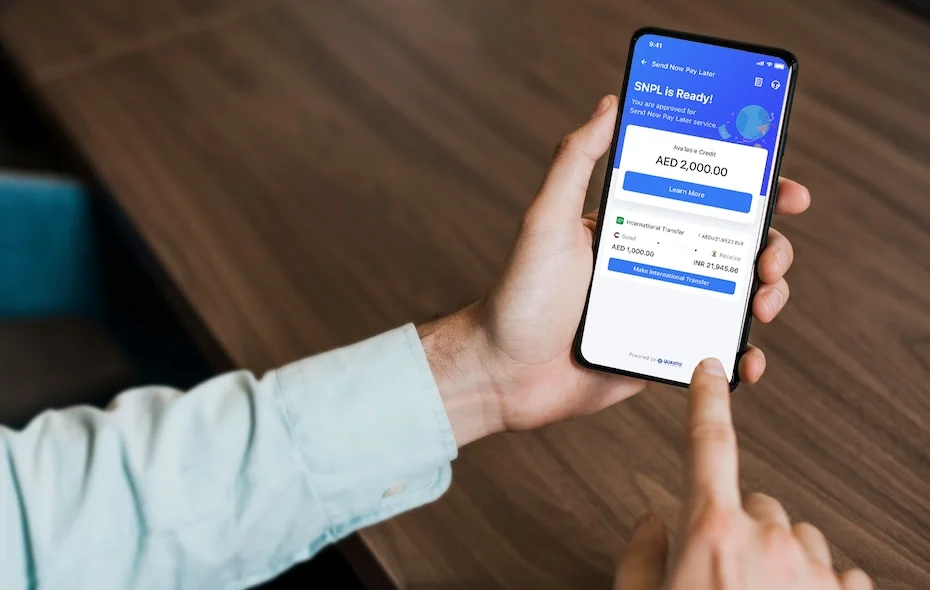

Dubai-based Astra Tech has shaken up the UAE’s financial landscape with the launch of its groundbreaking “Send Now,Pay Later” (SNPL) service via its Botim Ultra App. This marks a significant milestone, making Botim the first fintech company in the MENA region to offer such a service, solidifying its innovative position in the industry.

Flexibility at its Finest

The SNPL service, designed specifically with the UAE’s vast expatriate community in mind, provides a much-needed financial flexibility boost. Users can now send money internationally instantly, with the added convenience of paying later in affordable installments. This is particularly beneficial during financially tight periods like the end of the month, easing the burden on individuals who need to support families back home.

Building on a Thriving Fintech Ecosystem

The introduction of SNPL builds on Astra Tech’s growing fintech suite, which has witnessed remarkable growth in transaction volumes. Leveraging its previous successes in the remittance space, Astra Tech is strategically positioned to seize a significant share of the UAE’s substantial remittance market, estimated to be worth billions of dirhams.

Empowering Users, Supporting Economies

Abdallah Abu Sheikh, Founder of Astra Tech and CEO of Botim, emphasized the significance of this launch, stating that the ‘Send Now, Pay Later’ feature offers a faster and more accessible way to send remittances, empowering millions of users to effectively manage their finances while continuing to support their loved ones abroad.

A Step Towards Financial Inclusion

The launch of SNPL aligns perfectly with Astra Tech’s broader mission to enhance financial inclusion in the region. This initiative follows the acquisition of a Finance Company License through Quantix, a licensed financial service provider,enabling Astra Tech to offer diverse credit solutions.

Early Bird Access

Ahead of the official rollout, Botim’s 9 million users will have the opportunity to pre-register, securing early access to this innovative service that combines the speed of instant remittances with the convenience of flexible payments. This development is poised to transform the way people send money abroad, providing relief and empowerment to millions.