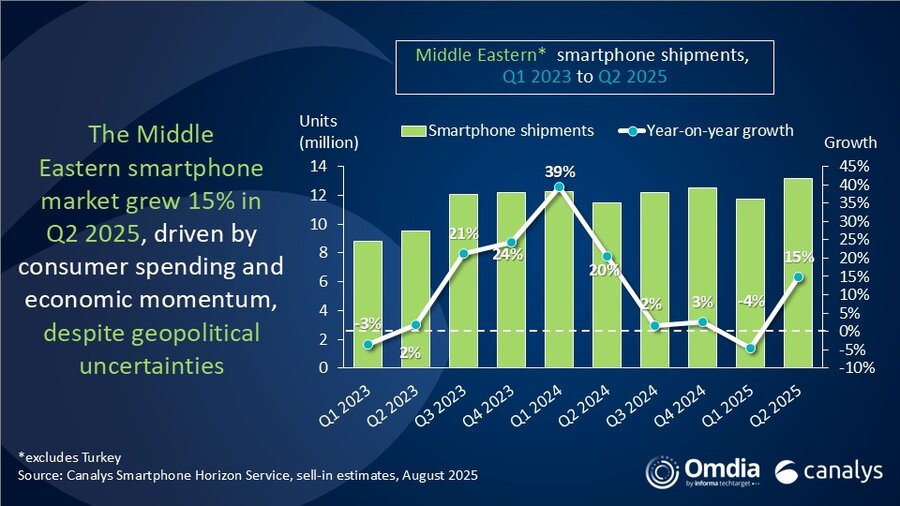

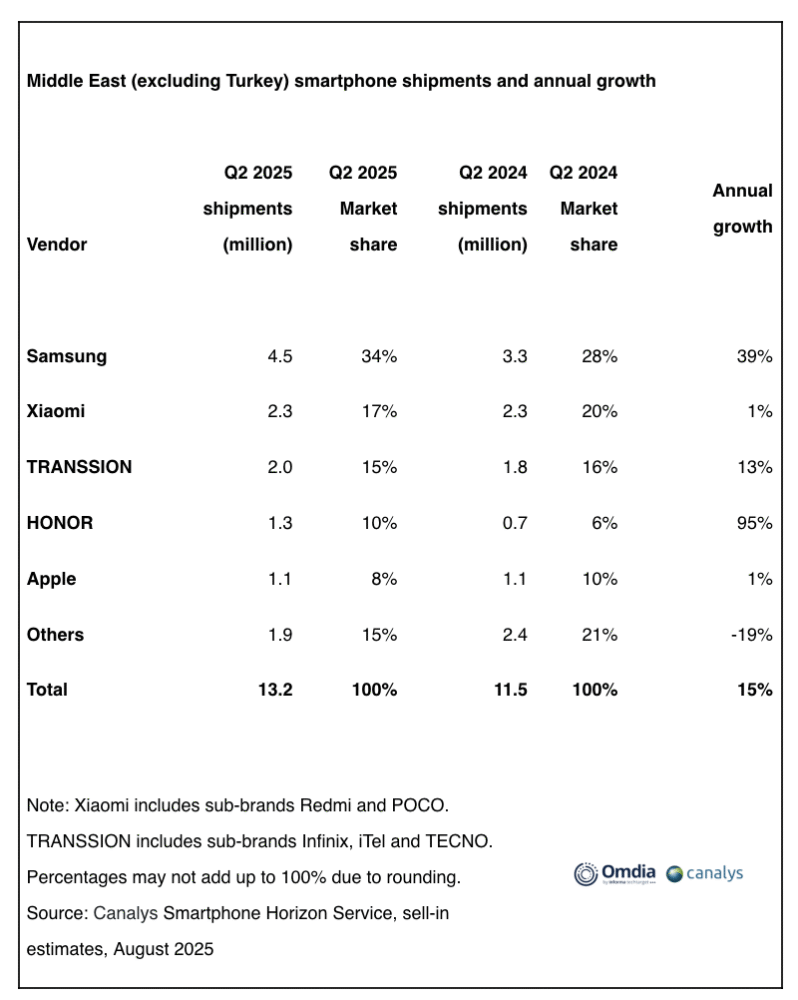

Smartphone shipments in the Middle East surged in the second quarter of 2025, rebounding after a slow start to the year and making the region the fastest-growing smartphone market worldwide. According to new industry estimates, shipments rose 15% year-on-year to 13.2 million units, the highest quarterly volume since mid-2019.

Analysts point to several factors behind the recovery: value-driven purchasing, festive season demand, and broader economic momentum across the region. Improved political stability, rising disposable incomes, and a steady flow of international visitors are also contributing to growth, positioning the Middle East as a key market for global smartphone vendors.

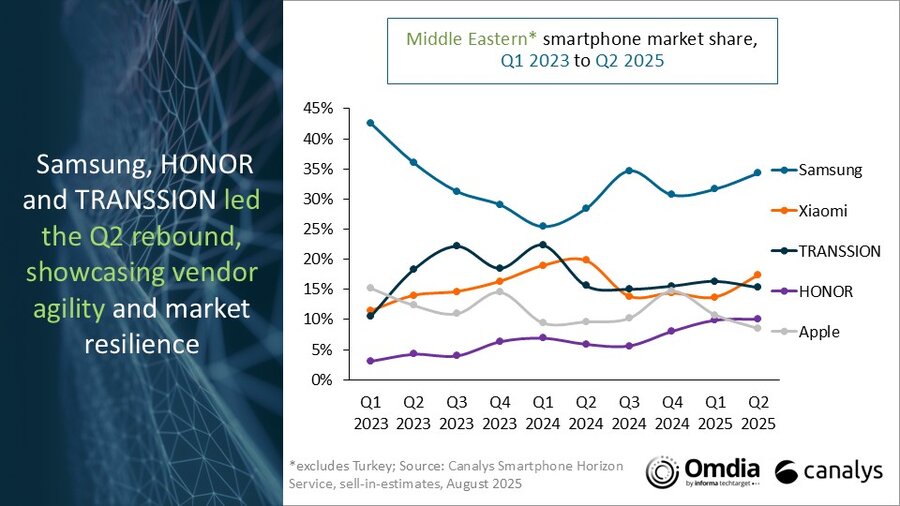

Samsung led the region with 4.5 million units shipped, a 39% annual increase that raised its market share from 28% to 34%. Strong sales of entry-level Galaxy A-series devices and continued demand for the Galaxy S25 lineup helped drive its performance, with installment-based purchasing options also fueling upgrades.

HONOR delivered the most dramatic growth, nearly doubling shipments to 1.3 million units compared with 0.7 million a year earlier, giving it a 10% share of the market. The brand’s expansion has been particularly strong in the Gulf states, supported by new retail outlets, promotional campaigns, and incentives for local sales channels.

Other major vendors saw mixed results. Xiaomi maintained steady shipments of 2.3 million units but saw its market share slip slightly to 17%. TRANSSION, whose portfolio includes Infinix, TECNO, and iTel, rose 13% year-on-year to 2.0 million units, holding 15% of the market. Apple was flat at 1.1 million units, with its share declining to 8%. Meanwhile, shipments from smaller brands collectively fell 19%, underscoring the intensifying competition.

Analysts note that artificial intelligence is becoming an increasingly important factor in the regional market. With the UAE, Saudi Arabia, and Qatar positioning themselves as global AI hubs, consumer interest is shifting toward devices offering real-time translation, personalized recommendations, and content creation features. Vendors are expected to lean on these AI-driven tools, along with influencer marketing and creator partnerships, to strengthen brand loyalty in a highly competitive environment.

With its second-quarter rebound, the Middle East smartphone market in 2025 is showing signs of becoming a growth engine for global manufacturers. If current momentum continues, the region could play an outsized role in shaping how vendors refine their strategies for both premium and mid-tier devices.